In this digital generation, money transfer apps have become famous due to their comfort and ease of use. Whether you’re a seasoned developer or just starting, this blog will provide valuable insights and practical tips to help you bring your money transfer app idea to life. So, let’s get started on this exciting journey of app development and revolutionize the way people transfer money!

What is a Money Transfer Application?

A Money Transfer App is a digital medium that permits individuals to send and accept money electronically. Gone are the days of carrying cash or writing checks, as these applications provide a convenient and secure way to transfer funds. With a money transfer app, users can link their bank accounts or credit cards to the application and transfer money to different users or even make payments to dealers. Overall, money transfer applications have revolutionized economic transactions, making it more manageable than ever to supervise and transfer money with just a few taps on your smartphone.

Essential Integration for Money Transfer Application

Essential integration plays a pivotal role in the seamless operation of a money transfer application. By integrating key features and functionalities, such as payment gateways and secure authentication protocols, users can enjoy a hassle-free experience while transferring funds. Payment gateway integration ensures the secure and efficient transfer of money from one account to another, allowing users to transact confidently.

Integration with banking systems and global money transfer networks enables users to send and receive money internationally, expanding the application’s reach and convenience. Overall, through essential integration, a money transfer application can provide a safe, reliable, and efficient platform for users to easily manage their financial transactions.

How to Create a Money Transfer Application

The procedure for how to Create a Money Transfer App is depicted as follows:

Step 1: Analyze business needs and elicit requirements

At this stage, our consultants work closely and consistently with the client’s team to thoroughly grasp their money transfer requirements or the app’s vision. This enables us to prevent the possibility of expensive redevelopment by comprehensively understanding their needs. This phase includes:

- Analyze a customer’s existing business situation and company requirements /product vision.

- Evoke and document necessities for the application, including:

- This app type needs a web or mobile app for money transfers.

- Necessities for the app’s functional capacities, for example, support for certain transfer types (P2P transfers, P2B transfers), transfer techniques (bank transfers, card-to-card transfers, etc.), money, transfer prototypes (e.g., recurring transfers), and more.

- The varieties and configurations of data the app should be able to process.

- UX necessities.

- Non-functional essentials for the app (performance, scalability, availability, latency, etc.), comprising safety and obedience conditions (with AML and KYC, PCI DSS, ISO 20022, etc.).

Step 2: Create a detailed project plan

Project managers establish the foundation for a transparent, KPI-driven collaboration with minimized risks by meticulously planning the development of a money transfer app. This phase includes:

- Defining objectives and KPIs.

- Determining project deliverables, duration, schedule, and budget.

- Choosing the roles in the assignment squad and designing collaboration workflows.

- Identifying possible project risks creating risk mitigation strategy and plan.

- Calculating TCO and ROI of the capital transfer application.

Step 3: Design a money transfer application

There are a few phases in this stage; these are mentioned below:

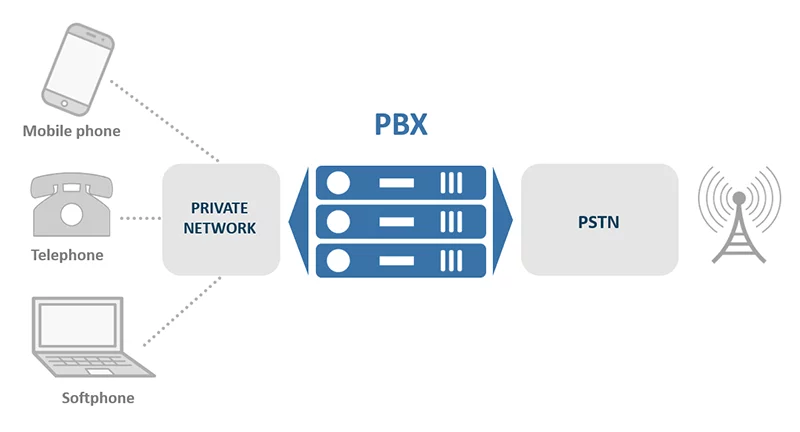

- Architecture design

We describe how the solution’s functional modules should perform at the code level and decide on the best-fitting approach to integrating the app’s components.

- A detailed list of features

Apart from the core features, the list covers suggested safety characteristics for the app’s infrastructure and subordination strategies to satisfy the required criteria and regulations.

- UX/UI design

The required user roles (individuals, corporates, admins, etc.). We perform UX analysis, deliver prototypes, conduct usability testing, create a visually appealing manner of the app, and furnish UI mockups.

- A plan of integration

We advise on optimal integration solutions (banking APIs, crypto APIs, etc.) and layout business integrations with existing back-office systems if required.

Step 4: Select an optimal tech stack

The development of a money transfer app necessitates the identification of necessary technologies and tools. Evaluating various technologies and tools within the scope of well-documented business requisites. Ultimately determining the most fitting technologies and tools for the project.

Step 5: Develop and test the application

This phase involves the configuration of CI/CD pipelines and establishing container orchestration tools to streamline the continuous app development, integration, deployment, and release processes. Once the automation environment is set up, our team proceeds to construct the app’s backend, incorporate a PCI DSS-compliant storage solution for storing users’ sensitive data, and design user interfaces based on distinct roles.

To ensure the highest quality, we thoroughly assess each app component and assess the seamless integration of these components in conjunction with coding to rectify any potential vulnerabilities, logical flaws, or defects before the deployment stage.

Step 6: Establish app integrations

In this phase, the integration of the app with the necessary software is carried out by the NavinaInfotech team. Integration testing is performed to ensure the successful operation of the integrated solution.

Step 7:Deploy the application to production

To make the app fully operational, we handle the setup of its infrastructure, establish backup and recovery protocols, apply the necessary security measures (such as API authorization controls, DDoS protection algorithms, firewalls, IDSs / IPSs, etc.), and ensure the app is available for immediate use.

It is worth mentioning that NavinaInfotech also offers support in developing a website for app promotion or publishing the money transfer app on web and mobile app stores as part of the app release optimization process.

Step 8: Handle after-launch app support and evolution

To ensure the long-term functionality of the money transfer app, NavinaInfotech provides a variety of services. Specifically, our team is equipped to:

- Effectively manage and address operational issues within the app.

- Increase the app’s capacity to accommodate a rising user base.

- Conduct comprehensive audits to ensure security and compliance.

- Continuously develop and deploy new features to meet the changing requirements of both the company and end users.

Key Features of Money Transfer Application

As an essential digital Finance App Development, the money-transferring application offers extensive features that ensure easy and safe transfer of funds, complete transparency, and efficient management of transfer transactions. Some of them are mentioned below:

- Account management

Personal information, such as billing address, bank account details, and payment card information, can be added, saved, and updated. Accounts support multiple languages.

KYC verification is based on geography. A mobile app development company is available to assist app users with account-related problems.

- Sending and receiving money

Custom mobile app development provides support for various digital money transfer methods. Transferring funds to a bank account by utilizing the recipient’s name, address, and account number or the SWIFT or IBAN of the recipient’s bank for international transfers. Enabling electronic money transfers within the same bank, as well as between different banks. Facilitating both domestic and cross-border transfers. Conducting multi-currency transfers, including transactions involving cryptocurrencies.

- Funds movement tracing

An Android App Development Company has an instantaneous overview of the funds sent and received. A comprehensive record of past money transfer transactions is available. Reports on the movement of funds, including period, category, and transaction amount, can be generated automatically. The tracking of transaction fees, such as international transfer fees and funds withdrawal fees, is facilitated. The option of an immutable record in the blockchain ledger ensures enhanced traceability of transfer transactions.

- Balance management

Balance management in a money transfer app is like having a digital wallet on your phone. You can easily track your transactions, history, and more. It’s like a mini bank in your pocket. The dashboard can be customized to display the latest currency exchange rates.

If you need this feature to work easily and safely on your app then you should hire an Android app developer. They can create a clear and simple design, make sure your money is secure, and send you alerts when something important happens with your balance. This makes your app trustworthy and user-friendly.

- P2P borrowing request management

Creation of borrowing requests using templates by Android app Development India. Submission of borrowing requests to a specific peer, either on a scheduled or ad hoc basis. Personalizable dashboards displaying borrowing requests and related transactions. Lenders are notified about received borrowing requests, while borrowers receive notifications about approved borrowing requests. Peer-to-peer instant messaging is available for convenient communication.

- Security and Compliance

Encryption techniques are utilized for safeguarding money transfer data, with a focus on asymmetric encryption for crypto transfers. Using AI technology enables efficient fraud detection, empowering the system to identify and alert any suspicious user activity. Transactions are securely signed electronically for increased authentication. hire ios app developer to strict regulatory measures is ensured, including compliance with AML/KYC, PCI DSS, ISO 20022, PSD2, and GDPR, especially in the European Union (EU), as well as other pertinent global, country-specific, and industry-specific regulations.

Conclusion

Creating a money transfer app can be a complex procedure, but with the right direction and knowledge of the steps involved, you can develop a successful and safe application. Nearly 50 million people worldwide use online money transfer apps. Whether you are a skilled app innovator or somebody with no technical knowledge but an idea in mind, our guide has furnished you with the important data to get started. Good luck with your mobile app development services journey, and we look forward to seeing your innovative money transfer app in the market!

Author Bio:

Rahim Ladhani: CEO at Nevina Infotech

Rahim Makhani is the CEO and director of the custom software development company Nevina Infotech. He has 8+ years of experience in innovating new technologies in the field of software development. His vision is to serve small and large firms with the best services and resources. He has been a proficient leader who can effectively handle clients, and management teams as well as have amazing decision-making and problem-solving power.

Leave a Reply