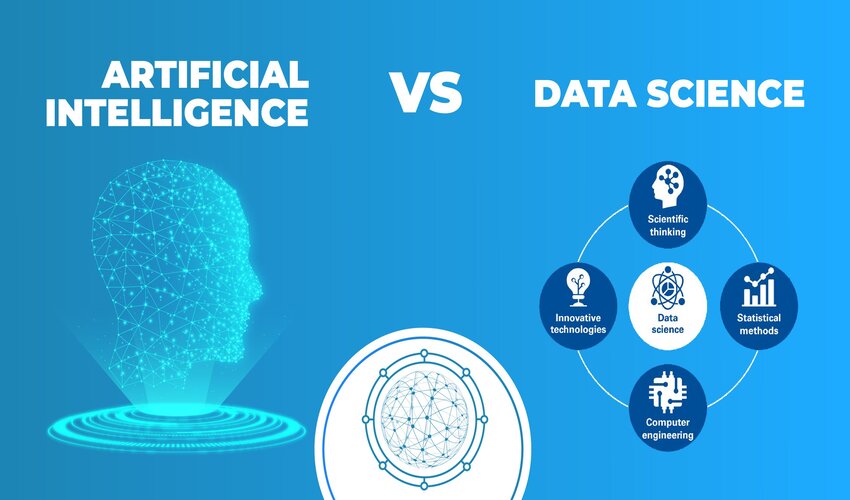

These are exciting times for every industry, and especially fintech! It’s 2024, and artificial intelligence is no longer just a sci-fi dream – but in fact, it is the powerhouse that is driving the fintech revolution. Let me take you for a quick dive into the most insane, mind-blowing developments that are reshaping how we handle our cash, invest our money, and even how we view money itself.

Here is a list along with an overview of all the latest trends and innovations in the fintech industry.

- Chatbots and Virtual Assistants: Your New Money BFFs

To begin with, let’s talk about your new financial best friends – AI chatbots and virtual assistants. You’d think these are one of those clunky, automated phone services, but please allow me to correct you here. I am talking about super-smart, conversational AI chatbots that help you manage your money like an expert. Need to check your balance, transfer some cash, or even get investment advice? Your AI BFF will help you out. It’s almost like having a financial advisor in your pocket 24/7, minus the suit and tie, of course.

- Personalized Banking: Netflix-Style Money Management

Imagine Netflix, but for your finances. Seems convincing, right? AI in fintech is making banking as personalized as your movie recommendations. There are advanced algorithms that analyze your spending habits, income, and financial goals to offer tailor-made advice. Whether you’re saving for a brand-new gadget or planning an international trip, AI has got your back with customized saving and investment plans.

- Fraud Detection: AI’s Got Your Wallet’s Back

Artificial intelligence in finance is the superhero we didn’t know we needed in fraud detection. Fintech software development companies are using machine learning to analyze millions of transactions in real-time, spotting patterns and anomalies faster than any human could. Do you know what that means? It means your hard-earned cash is safer than ever. If someone tries to make a transaction with your credit card in a city you have never visited, AI will flag that faster than you can say “not on my watch!”

- Algorithmic Trading: Making Money While You Sleep

This is one of the most exciting and interesting applications of AI in fintech: algorithmic trading. Advanced AI systems analyze global financial markets, make predictions, and execute trades at lightning speed. We are talking milliseconds here! These algorithms are capable enough to spot trends and make moves before the rest of the market even wakes up, giving savvy investors an edge. It’s like having your stock portfolio being managed by the most efficient investor in town.

- Blockchain and AI: A Match Made in Digital Heaven

Blockchain and AI together make a perfect combination, and I am here to tell you how! Blockchain’s secure, transparent ledger combined with AI’s analytical power is transforming everything right from currency transactions to securing personal data. This useful tech-stack is helping create a world where your financial and personal data is uber-secure and transactions are as transparent as it gets.

- Credit Scoring: AI Knows You Better Than You Know Yourself

Say goodbye to traditional credit scoring because artificial intelligence is taking over with more accurate, fair, and inclusive credit assessments. By analyzing a broader range of data points, including your shopping habits and social media activity, AI can assess your creditworthiness more holistically. It’s almost like having a detective digging through your digital life, but in a totally non-creepy way.

- Robo-Advisors: Investing for the Instagram Generation

Robo-advisors are the new wave of investing. These AI-driven platforms are making investing accessible, affordable, and more customizable than ever. Whether you’re a first-time investor or a seasoned pro, robo-advisors can help you build a portfolio that aligns with your goals as well as your risk tolerance.

- Insurtech: AI-Powered Insurance That Doesn’t Suck

Insurance can be a drag, but AI is changing that and how! Insurtech companies are using artificial intelligence to personalize policies, streamline claims, and even predict risks. So, if you’re knee deep into fitness, AI would be able to analyze your lifestyle and offer lower health insurance rates.

Wrapping Up: The Future of AI in Fintech Market

So, there you have it – AI is turning the fintech world upside down and fortunately, in the best way possible. It’s making finance smarter, faster, and way more personalized for everyone. Whether you’re a finance guru or just trying to manage your allowance, fintech AI has got something for you. Stay tuned, because much exciting times lie ahead.

Staying on top of the latest trends in the fintech industry is a sure shot way of leveraging the best of this technology to your benefit. About time you took one step further towards making a mark in the fintech domain – powered by artificial intelligence.

Author Bio:

Anil Rana is a dynamic professional who primarily focuses on digital asset management and business analysis. With over 14 years of experience, Anil works closely with requirement gathering, analysis, estimation, design, development, testing, and production support at

Seasia Infotech while supporting business solution software and analyzing business operations for top global enterprises. He possesses multiple certifications that include Certified Scrum Master and Certified Product Owner.

Leave a Reply